Which American Legion posts raised the most with charitable gambling?

ST. PAUL — The Minnesota Gambling Control Board came out in November with its annual reports for the fiscal year ending June 30, 2023.

It’s easy to add up the totals statewide and determine that more funds were given to the state than were given to charities or programs. Add taxes, charities and programs together, and you get the amount classified as “lawful purpose expenditures.”

In the fiscal year that ended in June, 53 percent of LPE went to paying taxes and fees. That’s 53 percent of the money raised did not go to charitable efforts or programs.

Allowable expenses, listed below, cover wages, costs of games, equipment and other expenses related to running charitable gambling and do not play a factor in how taxes are calculated.

Total American Legion posts and units with gambling: 193

Gross receipts: $426,029,573

Prizes: $362,599,591

Net receipts: $63,429,983

Allowable expenses: $31,127,178

Taxes & Fees: $17,362,690

Charities: $9,303,579

Programs: $6,084,815

Total LPE: $32,751,084

%LPE for taxes: 53

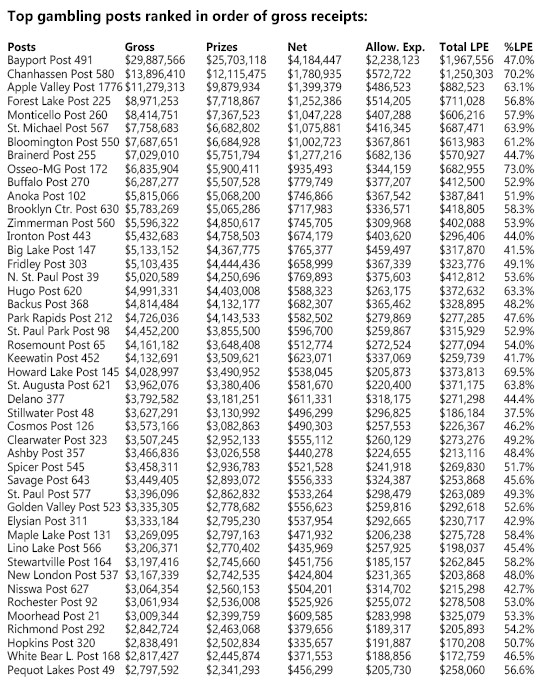

Below is a chart of the top 45 posts:

Click here to download the Minnesota Gambling Control Board Annual Report.

The Minnesota Gambling Control Board Annual Report came out Nov. 10. It said in the fiscal year that ended June 30 that gross receipts among all licensed gambling organizations achieved a record high: $4.6 billion. It was a 7.5 percent increase from the year fiscal year and a 48.1 percent increase from FY21.

“Minnesota’s lawful gambling gross receipts have increased 275% over the past 10 years,” the report states.

Total sales minus prizes and allowable expenses totaled $330 million, a 1.5 percent increase from FY22. This has seen a 231 percent hike in the past decade.

“Licensed and exempt nonprofit organizations used lawful gambling to raise approximately $157 million for their charitable missions.”

Total state taxes paid: $193 million, which was a 7.2 percent increase over last fiscal year.

Get this: E-tabs made up 51.1 percent of total sales, and paper pulltabs comprised 44.7 percent. This is the first time e-tabs have surpassed paper tabs. Bingo, tip boards, raffles and other forms of gambling covered the remaining percentage.

In all, there are 1,144 licensed organizations conducting lawful gambling at 3,026 premises throughout Minnesota.