The changes to electronic pulltabs did hurt gambling revenue

DULUTH — Charitable gambling in Minnesota donated more than $139 million to charitable causes and their own nonprofit missions in the fiscal year that ended June 30, 2025, an 8.9 percent increase from the prior year.

The Minnesota Gambling Control Board comes out with its annual report every November, just in time for the Allied Charities of Minnesota Convention. This year, the big gambling gathering took place Nov. 20 and 21 at the Duluth Entertainment Convention Center.

The big question: Would the rollout of new electronic pulltab games — stripped of bonus games, free plays and open-all buttons — impact revenue?

It did.

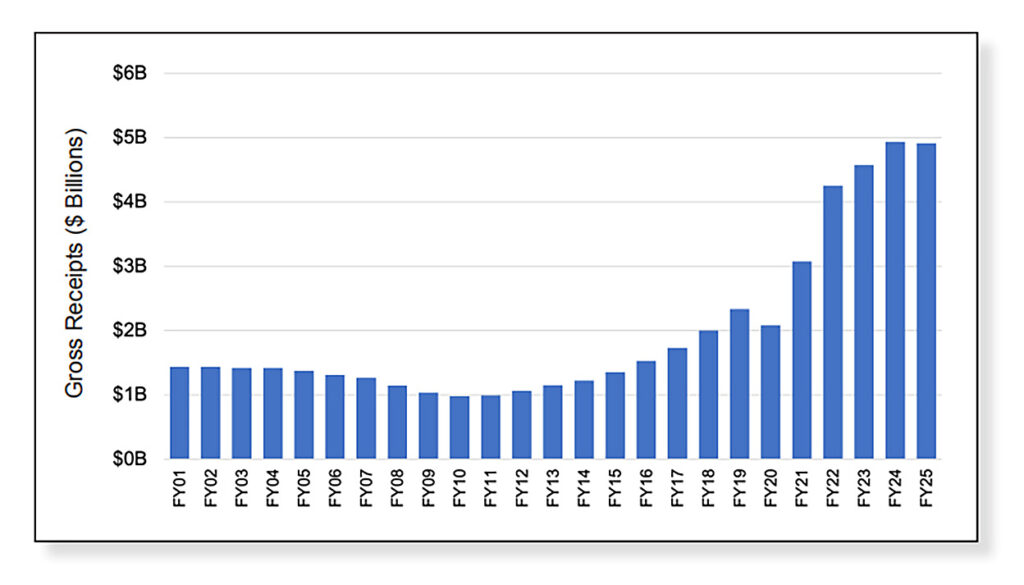

Gross receipts are total sales before prizes are awarded. It’s a true measure of customer traffic.

Fiscal year 2025 experienced the first decline in gross receipts since 2020, which, in itself, was the first decline since 2010. E-tabs were introduced in 2012. That means the changes resulted in the first decrease in revenue for charitable gambling in 15 years, except when state-mandated shutdowns closed the bars.

Gross receipts for all licensed organizations in FY2025 came to $4,910,315,372. For FY2024, it was $4,935,680,755. That’s a decline of about half of 1 percent. Donations were down about the same, too.

For perspective, look back at fiscal year 2001, and the same figure was just over $1.4 billion. FY2025 is an increase of 250 percent over FY2001.

Allied Charities of Minnesota Director Rachel Jenner spoke to the convention. The new e-tab games went into effect Jan. 1, 2025. She said gambling revenue declined 13 percent in January-March.

“But in true Minnesota charitable gambling fashion, we adapted,” Jenner said. “Throughout the year, revenues steadily climbed as we overcame the challenges of the transition.”

Jenner noted that, while gross receipts might be down, net receipts — the money after prizes are awarded — was up by about $1 million.

FY2024 net receipts were $709,696,072. FY2025 came to $711,452,397, an increase of a quarter of 1 percent.

The real help came in the form of slightly reduced taxes and e-tab fees, she said.

“The combination of reduced tax rates and reduced e-tab manufacturer fees helped drive a $7 million increase in donations and local taxes/fees compared to 2024. And despite the lower tax rates, the total taxes paid to the state still increased by just over $1 million, totaling $196,224,894,” Jenner said.

Gambling Control Board Director Laura Wade shared many of the same highlights and noted e-tabs were down 4.6 percent for the year. Paper pulltabs were up 4.5 percent.

She said it was a good year for charities overall. Ward said the cap on e-gaming provider fees, which is 25 percent of net receipts, saved about $20 million for license holders.

The Gambling Control Board, she said, is now fully staffed. It rolled out a new website, and is moving toward having a portal to accept online payments of licensing fees.

How much in taxes did licensed-gambling organizations pay to the state government in FY2025? The answer is $208,280,383 to the general fund, up less than 1 percent from $206,410,064 the prior year.

Allowable expenses were down. This is the cost of games, supplies, wages, rent, acrylic boxes, dispensers, bingo cages and such. (An average paper pulltab game costs anywhere from $60 to $90.)

FY2025 allowable expenses came to $356,326,176, down 2.2 percent from $364,355,149.

American Legion Family

Gambling sales at American Legion Family licensed organizations were slightly down in fiscal year 2025 than the previous year, but they managed to increase donations.

There are 188 licensed posts, three licensed units and one licensed 40&8 voiture. They sold $450,528,094 in gambling products in FY2025.

That’s down 2.2 percent from FY2024, when they sold $460,467,719.

In the past fiscal year, three posts gave up their gambling licenses: Wells Post 210, Gaylord Post 433 and Mahtomedi-Willernie Post 507.

Net receipts for FY2025 came to $67,006,201, a decrease of 1.66 percent from 68,135,331 the prior year.

However, total charitable contributions and mission-related expenses came to $15,849,993, up 1.1 percent from $15,678,791 last year.

Taxes ended up almost the same. They were $17,397,189 in FY2025, slightly down from $17,641,874 in FY2024.

Allowable expenses were $33,701,554 in FY2025, down 1.1 percent from $34,085,331 the prior year.

Bayport Post 491 topped the list in terms of revenue. Others in the top-ten were: Chanhassen Post 580, Apple Valley Post 1776, Forest Lake Post 225, Buffalo Post 270, Bloomington Post 550, Brooklyn Center Post 630, Monticello Post 260, Osseo Post 172 and Brainerd Post 255.

Find the numbers for all licensed organizations at mn.gov/gcb/publications/org-reports/.

Email [email protected] to request a spreadsheet of American Legion FY2025 figures ranked by gross receipts and their associated star reports.

Legislative

ACM’s Rachel Jenner also spoke about legislative priorities in 2026. She said ACM supports a sports-betting bill that includes stepped-down charitable gambling tax rates over three years, moving to rates of 3, 10, 18 and 26 percent.

“By year three, this would result in $40 million in annual tax relief, potentially more if revenues continue to grow,” she said.

The current tax rates are:

- 8 percent on the first $87,500 in net receipts.

- 17 percent on net receipts over $87,500 and less than $122,500.

- 25 percent on net receipts over $122,500 and less than $157,500.

- 33.5 percent on net receipts over $157,500.

That said, ACM hopes to introduce a stand-alone tax bill with the same reduced rates, considering the sports-betting bill has had problems getting widespread support in the Legislature, despite being surrounded by states where it is legal.

Furthermore, ACM plans to codify changes to the fund-loss process.

“We want to ensure that organizations are no longer required to reimburse denied fund losses from non-gambling funds,” Jenner said.

Rule changes

The comment period closed Dec. 15 for several rule changes the Gambling Control Board was considering. Any implementation of these rules, should the GCB approve them, is undetermined.

The GCB has opened the rules on 5 topics:

- Add CEO gambling class requirement.

- Provide greater transparency to organizations as to why the GCB approves or denies a profit carryover adjustment that results from a fund loss and limit the punitive damages by no longer requiring that a fund loss be reimbursed with non-gambling funds.

- Require organizations to include eligibility requirements in their house rules when awarding merchandise prizes such as firearms, alcohol and THC products.

- Allow organizations to acquire gambling equipment approved by the GCB through alternative means when the equipment is not available through licensed manufacturers. The main example being a bingo cage.

- Allow non-licensed charities to conduct an exempt and excluded raffle in the same year.

Banquet speaker

The speaker at the ACM banquet was the Legion’s own Kristy Janigo, who is the former chair of the Department Legislative Committee. She spearheaded the Legion’s efforts to get laws passed for veterans in Minnesota for three years. That included efforts to reduce taxes on charitable gambling and to prevent stripping away features from e-tabs.

Janigo is a Maple Grove City Council member and a member of Osseo-Maple Grove Post 172. Her speech reflected on the struggle to get meaningful tax reduction for the licensed charities, with bills dying on the final day of the session in 2024 and early on in the session in 2025.

“But, friends, at this point, I think we need to take a different approach,” Janigo said. “We need to tell our stories and get people to care. Tell your stories to anyone who will listen — your neighbors, your coworkers, your family, everyone.”

She also is a Hennepin County veteran service officer, and she told how veteran posts donate to help homeless veterans while they wait for the wheels of state or federal government to slowly turn.

Janigo urged all involved in charitable gambling to set aside party divisions and get pro-charitable-gambling politicians elected to city councils, county boards and the state Legislature — and make sure their words aren’t hollow.

“Now, we are just asking government to get out of our way so we can do the good in the community we’re accustomed to doing,” she said.