House Tax Committee passes sports betting bill with charitable tax relief

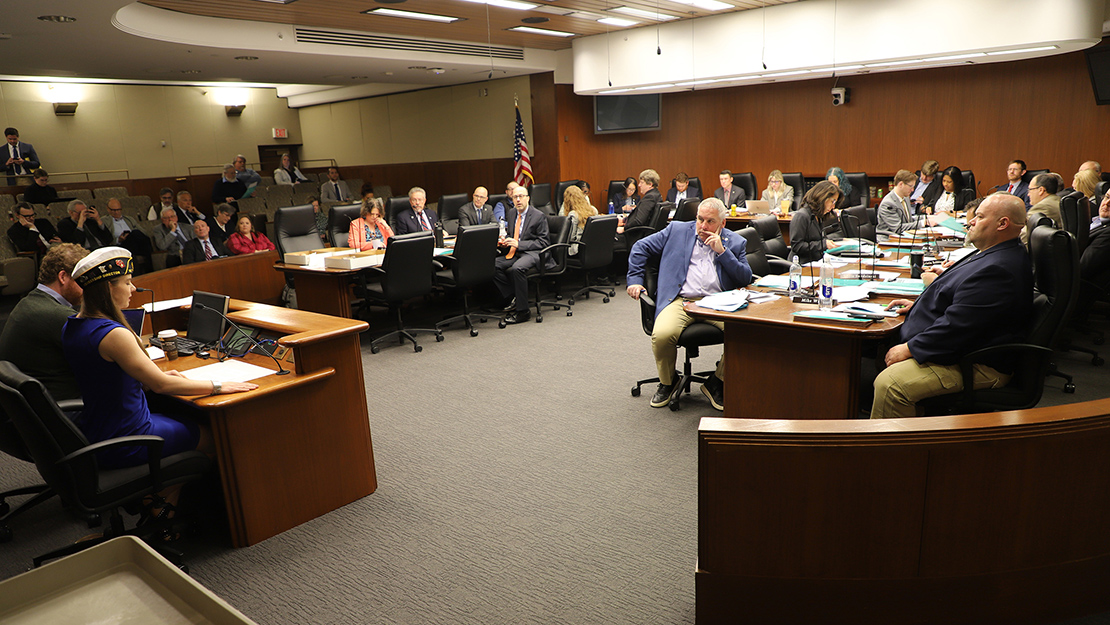

ST. PAUL — The sports betting bill, which features tax breaks for charitable gambling valued at $40 million a year, moved on Tuesday, April 30, after a hearing in the House Tax Committee.

The committee gave the bill the green light, and now House File 2000 heads to the House Ways & Means Committee.

Chief author Rep. Zack Stephenson of Coon Rapids testified that charities currently pay more in taxes than they are able to give to the causes they support.

The bill features provisions to allow veteran service organizations such as American Legion posts to use more of their net receipts for building maintenance. Stephenson cited the closure of the post home for Coon Rapids Post 334.

“It had a devastating effect on our community,” he said.

Allied Charities of Minnesota Executive Director Rachel Jenner told the Tax Committee that charitable gambling has been promised tax breaks for decades. In recent years, the line was wait until after US Bank Stadium was paid off.

“Our efforts to serve our community have been hampered by these taxes,” she said.

American Legion Legislative Chairwoman Kristy Janigo thanked the supporters of the bill and asked opponents to get behind it considering some other similar bills failed to pass.

She said the Legion has led the way on prioritizing tax cuts this session. Tax breaks will allow veterans to do more good deeds in their towns.

“Veterans have a deep-seated need to serve their communities,” she said.

Janigo listed examples: honor guards, outdoor recreation for disabled veterans, suicide prevention, stop-gap funding for homeless veterans, housing and food for insecure children, local fire departments, youth sports, scholarships, human service nonprofits and other needs.

“What I am describing to you represents the best of America, and these traditions need to continue,” she said.

The committee voted down an amendment 10-9 with 2 excused. (The two representatives had to attend a nearby committee hearing but showed up by the end.) It would have deleted the sports betting language and reduced charitable gambling to a flat 5 percent tax.

Stephenson pointed the amendment lacked a funding source for the tax cuts. He reminded the committee the funding source for the tax cuts was the revenue from sports betting.

The amendment supporters felt the legislative damage done to etabs in 2023 would “devastate” charitable gambling operations. Stephenson disagreed, noting that game manufacturers already are producing new games that meet the new rules.

The final vote on HF2000 to support the bill was 12-9.