Legislative stance on charitable gambling for 2024

There is plenty of debate over what happened in 2023, but what are nonprofit organizations asking from the 2024 Legislature?

Here it is:

• Provide meaningful tax relief. Last session, the lawmakers granted tax relief bringing the top-tier from 36 percent to 33.5 percent, a slim reduction. Charities want that level to be 25 percent but would accept 30. The corporate income tax rate in Minnesota is 9.8 percent. Why are charities being taxed so harshly in comparison? The funds charities raise largely go back into their local economies and the good causes they donate to provide a valuable safety net for the disadvantaged.

• Broaden the tax structure. Right now, once an organization reaches $157,000 in combined net receipts for their fiscal year, they already are at the top tier for monthly taxes. ACM and other organizations want to modernize the tier structure for the current economy. This, too, would provide some measure of tax relief. The other tiers presently are 25 percent for over $122,500 accumulated, 17 percent for over $87,500 accumulated and 8 percent for starting off.

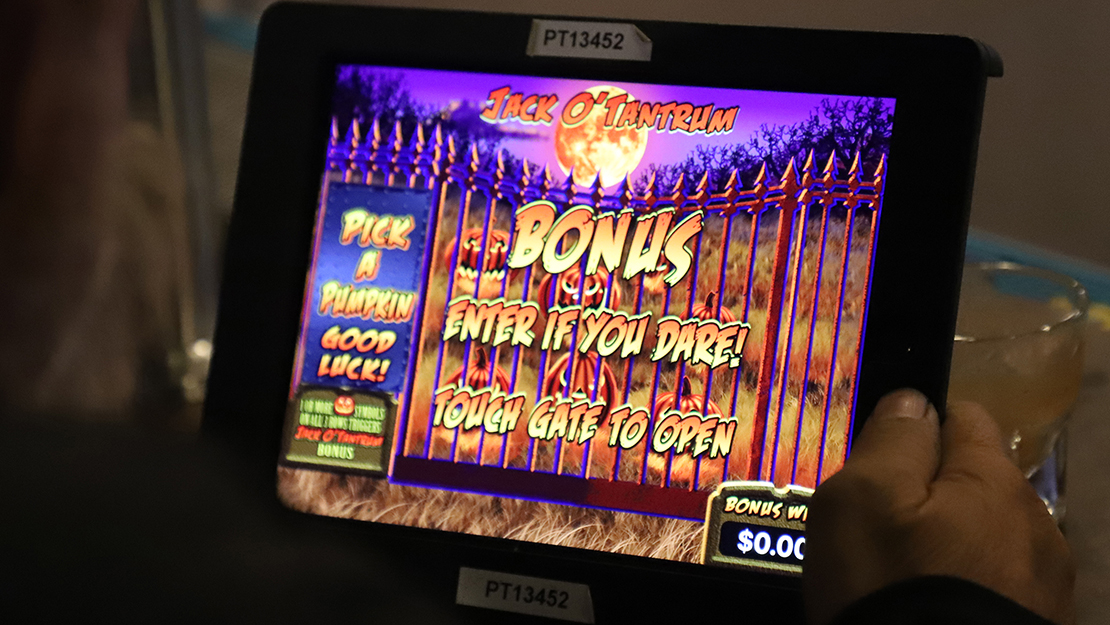

• Reinstate bonus games and free plays. Bonus games and free plays do not mimic slot machines in any way, and courts have ruled on this. What determines slot machines are variable prize structures, jackpots and unlimited bets — not bonus games or free plays. Besides, what’s the difference between awarding a free play on a $5 game or a $5 prize? Nothing. The tribes only asked for removal of the open-all feature last session. Inserting additional language was a punitive action by some anti-charity lawmakers.

• Push back the enactment date by one year. This e-tab industry took 10 years to build, and the Legislature asked the gaming industry to revamp it in one year. That’s not possible. What if by January 2025 there have only been four games approved? What if there are 25 games approved but they are all dull? Either way, gaming revenue crashes. There remains a lot to figure out in the next year. Move enactment to January 2026.

Click here to read about the 2023 Allied Charities of Minnesota Convention.